is probably not in finance

Do you love your bank? Like your bank? Respect your bank? Do you struggle to even tolerate your bank? Hold that thought.

Marketing chiefs the world over, whether they represent small start-ups or global corporations, obsess over how their brands resonate with customers. Brand love is simply better for business.

The digital world offers a suite of fairly involved tools to measure brand sentiment and where companies sit in customer consciousness at any one time. Usually, shortfalls or dips in customer sentiment will trigger action as brands address any bad links in the chain and re-establish their place in people’s hearts and minds.

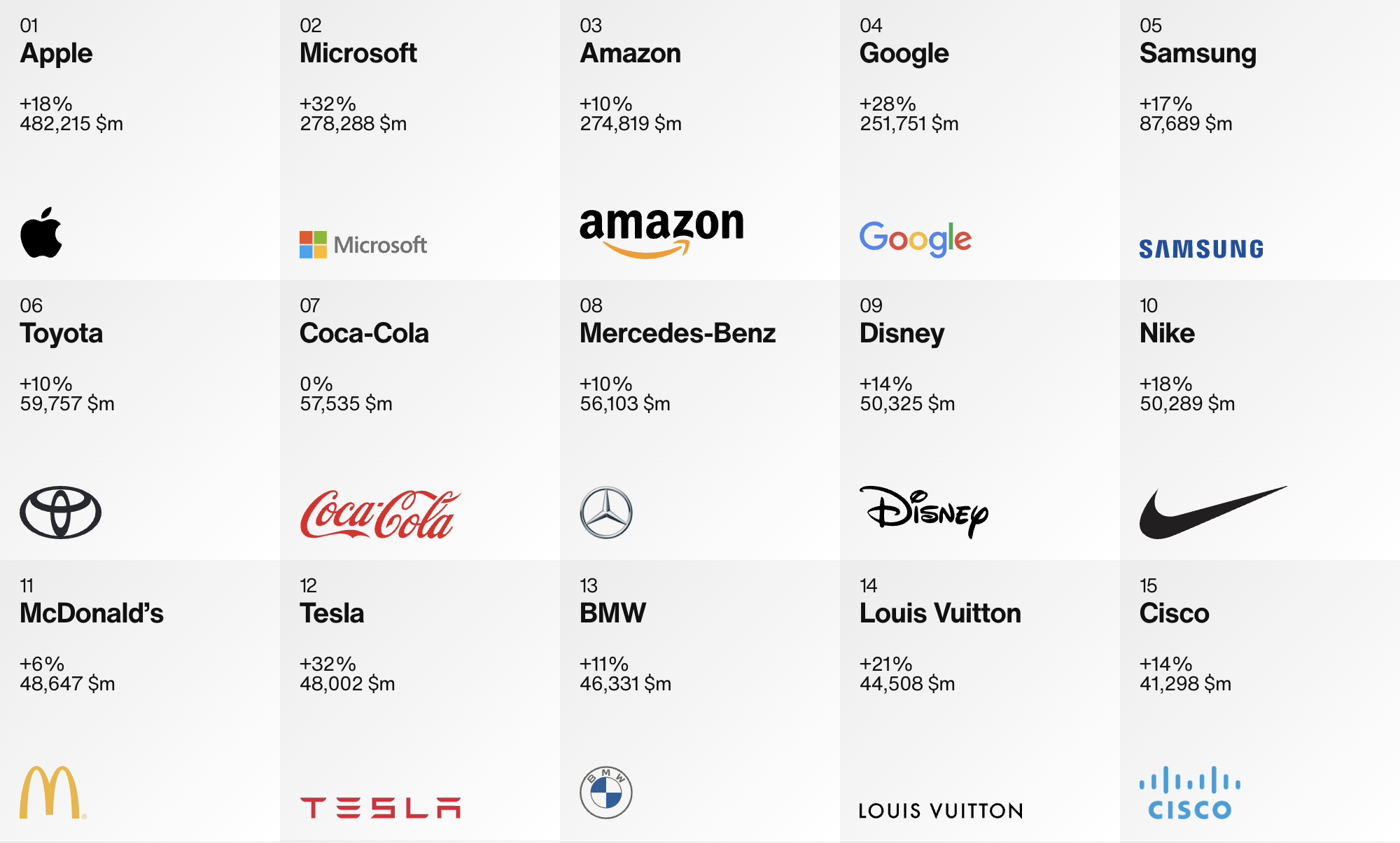

The graphic above shows a quick snapshot of people’s favourite brands in the world — thank you Interbrand — and one thing immediately stands out …

Where’s team finance?

Transaction or connection

Any marketer can probably tell you about Simon Sinek’s golden circle philosophy, which states that brands, businesses and institutions fare best when they start not with what they do (provide / make stuff), or how they do it (using clever kit) but why they do it.

It’s all about the high-level mission. The purpose. The raison d’etre.

Now banks. Ask people in the street why banks and financial services institutions are in business and you’ll probably get some really cynical answers.

To make money, to gouge the little guy, to make the rich richer …

You could write PhD papers on why banks and FS firms don’t have pride of place in customers’ hearts the way, say, LEGO does, but somewhere in that thesis is the longstanding lack of emotional connection between company and customer.

That mightn’t have mattered a few generations ago but it’s a new day, and that emotional connection is vital. It’s much more sustainable and valuable to both parties over time than is a begrudging relationship … and a few new kids on the block have noticed.

Conditions for change

If you don’t do it yourself we’ll make you. Banks and FS firms that have, for whatever reasons, been unable and / or unwilling to do more to put customers at the heart of what they do now find themselves with a sterner obligation to do so …

It’s true, even the regulators have lost patience. The FCA’s Consumer Duty, which kicked into life on 31st July 2023, demands that FS firms point (or repoint) their why at better customer outcomes, and they’ll be judged as such.

In essence, there has been a call-to-arms to put the service back in financial service.

In practise, this means meeting customers where they are physically, emotionally, financially, socially. It means doing more. It’s helping … really helping.

It is being more available. It is easy customer experiences. It is reliability and simplicity. It is greater access for all. It is providing relevant, clear and actionable information …

It addresses the basic stuff that your Apples do so well … and FS firms, well, don’t.

Failing in half the remit

Newly released, the FCA’s Financial Lives Survey 2022 shows that considerable numbers of UK customers think financial service firms seriously underperform at the coalface where it matters. Where firms actually meet and interact with their customers.

In the year to May 2022, 4.3 million people said they received unclear or untimely information from a provider and 7.4 million people said they simply had issues making contact at the point of need.

To draw a comparison, could you imagine Apple sending you something you didn’t understand? Could you imagine being on-hold at Apple support for 30-minutes-plus … in fact can you imagine having to call Apple support at all?

Apple have whole retail units that double as customer service HQs … and people actually look forward to going. On the other hand …

Trip to the bank? Do I have to …

Letter from the bank? Fear and confusion.

Gotta call the bank? Get a tea, it’ll be a while.

Just 41% of adults have confidence in the UK financial services industry and a barely one in three people (36%) believe that financial firms are honest and transparent.

A bigger why

Okay, we put up Apple as the benchmark and this often feels too lofty and convenient given they’re 1a or 1b in the world’s top companies. That’s valid.

But two things: traditional and heritage banks, the global lot, have the financials, brains, tech and nous to compete on the same scale. They can get the customer fundamentals into place.

And then this: there are plenty of examples of younger brands who outperform banks and financial service firms in these same fundamentals. Huel, Gymshark, AirBnB …

By baking the customer into the centre of the proposition, brands that are tiny in comparison to banks already hold places in people’s hearts and minds that longstanding FS firms can only pine for.

As if to make that point, the second graphic (above) in this week’s newsletter is a 2022 league table of customer satisfaction levels for UK banks.

Who’s up top? It’s not the big four. It’s not the established veterans. It’s not global lot. It’s the challengers, the digital-first brigade.

It’s those who started, perhaps, from a different place. A different why …