The Process

Your money life in one place

1. Your present

Your income, your spending, your debt

2. Your plan

Your goals and where you want to be

3. Your path

Actions, nudges and advice to get to where you’re going

4. Your future

Protection, investments, pensions and savings

Your present

Appraise where you are

Your income – all in one place so you can batch and add order.

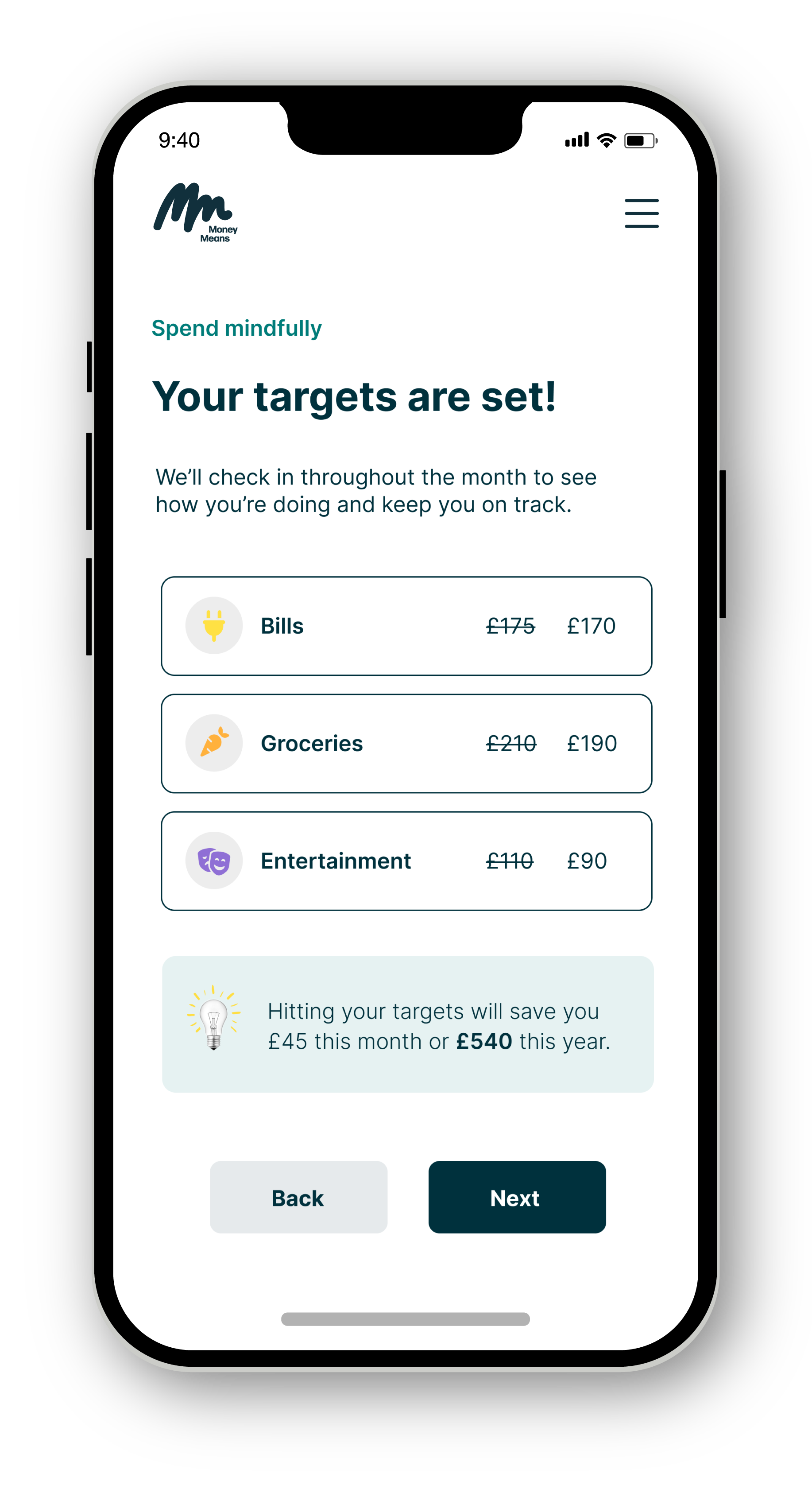

Your spending – appraise your spending and compile a budget that works.

Your debt – identify and compile your debt – start paying it off.

Your plan

Connect money and purpose

Income / savings / spending – align your day-to-day finances with your plan.

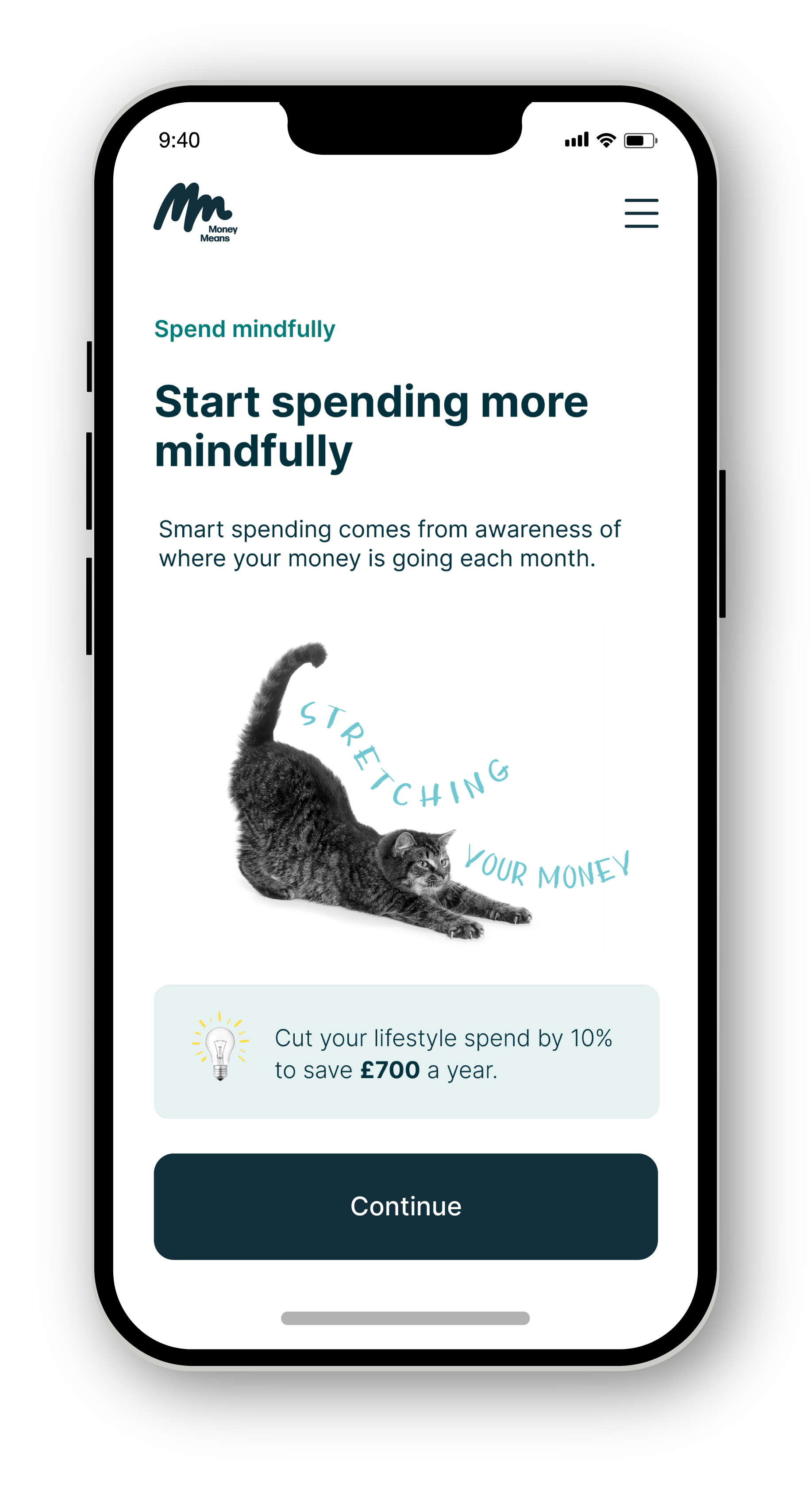

Conscious behaviour – take recommended actions; develop money consciousness.

Goal tracking – keep up with your plan and when gaps appear we step in.

Your path

Live today and build tomorrow

Info & actions – resources and tools grow your knowledge, confidence and skills.

Motivation & nudges – Money Means flag opportunities to save, invest and take action.

Coaching & advice – our experts are there when you need extra support.

Your future

Protect your people and plans

Investing & risk – set expectations, learn and get on with growing your money.

Pensions & protection – build safety nets so you can plan the future and protect it too.

Save more & worry less – organise your money life (so you don’t need to worry about it).